Just like a loan, a lender approves your software according to your credit history profile, earnings and various debts. Similar to a credit card, you draw what you may need and only pay out interest on the amount you employ.

In variable price loans, the desire rate might alter based on indices such as inflation or perhaps the central bank amount (all of which are generally in movement With all the overall economy).

(D) Short term payment accommodation in reference to a disaster or pandemic-connected national emergency usually means non permanent payment reduction granted to the customer resulting from fiscal hardship induced immediately or indirectly by a presidentially declared crisis or key catastrophe under the Robert T. Stafford Disaster Reduction and Emergency Guidance Act (42 U.S.C. 5121 et seq.

, 2nd-lien included transaction or HELOC) secured by exactly the same dwelling. Exactly where two or maybe more customers enter right into a legal obligation That could be a lined transaction, but only one of these enters into One more loan secured by a similar dwelling, the “identical buyer” includes the individual that has entered into the two authorized obligations. As an example, suppose Purchaser A and Purchaser B will both of those enter into a authorized obligation That could be a lined transaction which has a creditor.

six. The creditor disregarded proof that The patron would've the opportunity to repay only if The buyer subsequently refinanced the loan or bought the residence securing the loan.

) Notwithstanding any other provision of the section, if there is a delinquency of thirty times or maybe more at the conclusion of the 36th month in the seasoning interval, the seasoning time period will not conclusion until there is absolutely no delinquency; and

Although it might be tough to inquire, borrowing from anyone you realize could be a quick and inexpensive Answer. You’ll avoid the often lengthy formal application and acceptance processes demanded by other types of lenders. There’s also no credit history Verify with such a loan.

A creditor may well confirm The patron's income employing a tax-return transcript issued by the Internal Revenue Service (IRS). Examples of other documents the creditor may perhaps use to confirm The customer's money or assets consist of:

1. Payment calculation for any non-common home finance loan. In identifying whether the monthly periodic payment for a standard home finance loan is materially lower when compared to the regular periodic payment for the non-common house loan below § 1026.forty three(d)(2)(ii), the creditor must think about the monthly payment with the non-common house loan which will final result after the loan is “recast,” assuming considerably equal payments of principal and interest that amortize the remaining loan amount of money in excess of the remaining time period as on the day the home loan is recast.

ii. Adjustable-charge home finance loan with price cut for three several years. Think the exact same points as in paragraph 3.i other than that the life span maximum desire price is ten %, that's lower than the most desire rate in the initial 5 years once the date on which the initial normal periodic payment is going to be owing of 11 percent that might utilize but with the life time utmost curiosity charge.

Previous to that, she ran a freelance creating and enhancing company, in which she partnered with a wide array of clientele, like U.S. Lender and Under Armour. She graduated from Indiana College that has a bachelor’s diploma in journalism.

4. Verification of simultaneous loans. Whilst a credit history report can be accustomed to confirm present obligations, it will not likely replicate a simultaneous loan which includes not however been consummated and could not reflect a loan that has only recently been consummated. If the creditor knows or has cause to are aware that there will become a simultaneous loan prolonged at or prior to consummation, the creditor may well verify the simultaneous loan by getting 3rd-social gathering verification with the 3rd-party creditor with the simultaneous loan.

) The principal and desire used in pinpointing the date a periodic payment sufficient to deal with principal, fascination, and escrow (if relevant) for the provided billing cycle becomes owing and unpaid are classified as the principal and fascination payment quantities proven with the conditions and payment schedule of the loan obligation at consummation, except:

(A) The maximum fascination level which could apply in the course of the initial 5 years following the day on more info which the first common periodic payment will likely be because of; and

Ashley Johnson Then & Now!

Ashley Johnson Then & Now! Brandy Then & Now!

Brandy Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now! Meadow Walker Then & Now!

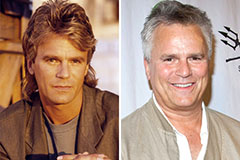

Meadow Walker Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!